Qualitative vs. Quantitative Research — Here’s What You Need to Know

Read Time: 0 Minutes

Qualitative vs. Quantitative — you’ve heard the terms before, but what do they mean? Here’s what you need to know on when to use them and how to apply them in your research projects.

Most research projects you undertake will likely require some combination of qualitative and quantitative data. The magnitude of each will depend on what you need to accomplish. They are opposite in their approach, which makes them balanced in their outcomes.

When Are They Applied?

Qualitative

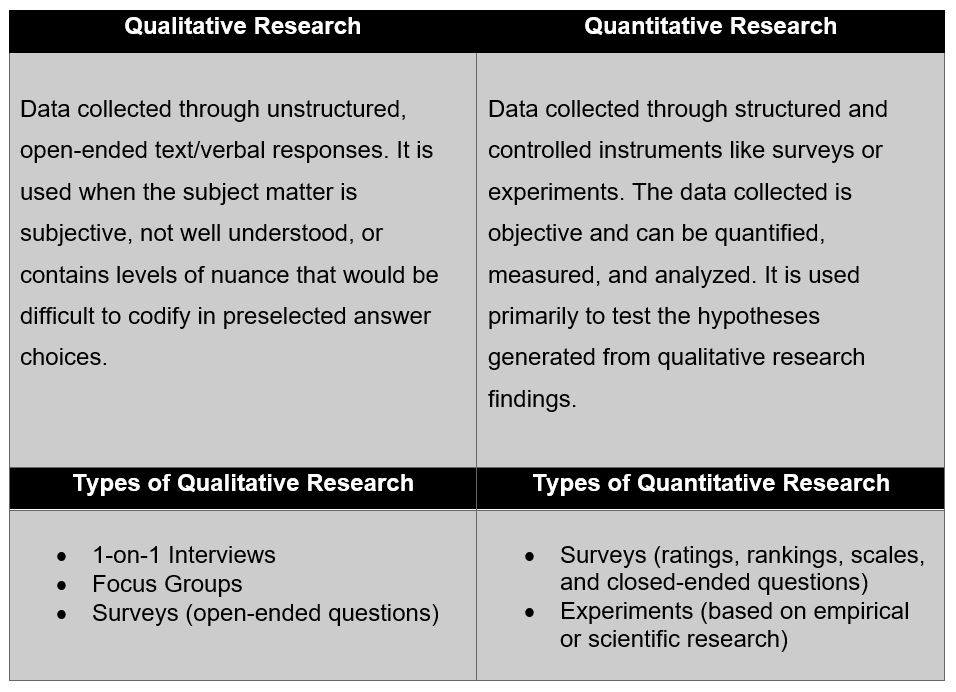

Qualitative research is used to formulate a hypothesis. If you need deeper information about a topic you know little about, qualitative research can help you uncover themes. For this reason, qualitative research often comes prior to quantitative. It allows you to get a baseline understanding of the topic and start to formulate hypotheses around correlation and causation.

Quantitative

Quantitative research is used to test or confirm a hypothesis. Qualitative research usually informs quantitative. You need to have enough understanding about a topic in order to develop a hypothesis you can test. Since quantitative research is highly structured, you first need to understand what the parameters are and how variable they are in practice. This allows you to create a research outline that is controlled in all the ways that will produce high-quality data.

In practice, the parameters are the factors you want to test against your hypothesis. If your hypothesis is that COVID is going to transform the way companies think about office space, some of your parameters might include the percent of your workforce working from home pre- and post-COVID, total square footage of office space held, and/or real-estate spend expectations by executive leadership. You would also want to know the variability of those parameters. In the COVID example, you will need to know standard ranges of square footage and real-estate expenditures so that you can create answer options that will capture relevant, high-quality, and easily actionable data.

Methods of Research

Often, qualitative research is conducted with a small sample size and includes many open-ended questions. The goal is to understand “Why?” and the thinking behind the decisions. The best way to facilitate this type of research is through one-on-one interviews, focus groups, and sometimes surveys. A major benefit of the interview and focus group formats is the ability to ask follow-up questions and dig deeper on answers that are particularly insightful.

Conversely, quantitative research is designed for larger sample sizes, which can garner perspectives across a wide spectrum of respondents. While not always necessary, sample sizes can sometimes be large enough to be statistically significant. The best way to facilitate this type of research is through surveys or large-scale experiments.

Analysis

Unsurprisingly, the two different approaches will generate different types of data that will need to be analyzed differently.

For qualitative data, you’ll end up with data that will be highly textual in nature. You’ll be reading through the data and looking for key themes that emerge over and over. This type of research is also great at producing quotes that can be used in presentations or reports. Quotes are a powerful tool for conveying sentiment and making a poignant point.

For quantitative data, you’ll end up with a data set that can be analyzed, often with statistical software such as Excel, R, or SPSS. You can ask many different types of questions that produce this quantitative data, including rating/ranking questions, single-select, multiselect, and matrix table questions. These question types will produce data that can be analyzed to find averages, ranges, growth rates, percentage changes, minimums/maximums, and even time-series data for longer-term trend analysis.

Mixed Methods Approach

You aren’t limited to just one approach. If you need both quantitative and qualitative data, then collect both. You can even collect both quantitative and qualitative data within one type of research instrument. In a survey, you can ask both open-ended questions about “Why?” as well as closed-ended, data-related questions. Even in an unstructured format, like an interview or focus group, you can ask numerical questions to capture analyzable data.

Just be careful. While qualitative themes can be generalized, it can be dangerous to generalize on such a small sample size of quantitative data. For instance, why companies like a certain software platform may fall into three to five key themes. How much they spend on that platform can be highly variable.

The Takeaway

If you are unfamiliar with the topic you are researching, qualitative research is the best first approach. As you get deeper in your research, certain themes will emerge, and you’ll start to form hypotheses. From there, quantitative research can provide larger-scale data sets that can be analyzed to either confirm or deny the hypotheses you formulated earlier in your research. Most importantly, the two approaches are not mutually exclusive. You can have an eye for both themes and data throughout the research process. You’ll just be leaning more heavily to one or the other depending on where you are in your understanding of the topic.

Ready to get started? Get the actionable insights you need with the help of GLG’s qualitative and quantitative research methods.

About Will Mellor

Will Mellor leads a team of accomplished project managers who serve financial service firms across North America. His team manages end-to-end survey delivery from first draft to final deliverable. Will is an expert on GLG’s internal membership and consumer populations, as well as survey design and research. Before coming to GLG, he was the vice president of an economic consulting group, where he was responsible for designing economic impact models for clients in both the public sector and the private sector. Will has bachelor’s degrees in international business and finance and a master’s degree in applied economics.

For more information, read our articles: Three Ways to Apply Qualitative Research,

Focusing on Focus Groups: Best Practices, What Type of Survey Do You Need?, or The 6 Pillars of Successful Survey Design

You can also download our eBooks: GLG’s Guide to Effective Qualitative Research or Strategies for Successful Surveys

订阅 GLG 洞见趋势月度专栏

输入您的电子邮件,接收我们的月度通讯,获取来自全球约 100 万名 GLG 专家团成员的专业洞见。